| paperabstracts.docx | |

| File Size: | 31 kb |

| File Type: | docx |

Research

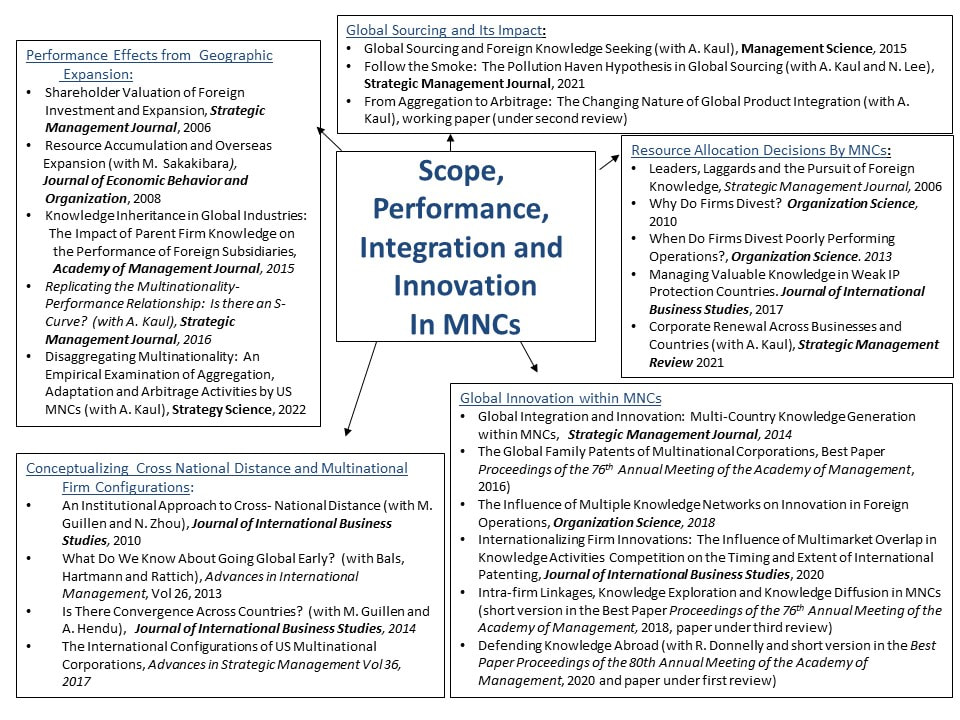

I would describe myself as an interdisciplinary researcher who works at the intersection of strategic management and international business. I am fascinated by the complex decisions that multinational corporations (MNCs) are confronted with – including product and geographic market scope decisions, when and how to integrate product and knowledge activities across markets and how to create and exploit global innovation. By combining and developing theoretical insights from the disciplines of strategic management, international business and international economics, my research contributes to our understanding of how firms successfully expand and compete across multiple product and geographic markets.

My research can be grouped into five broad themes: 1.) Performance Effects from Geographic Expansion; 2.) Resource Allocation Decisions by Multinational Corporations; 3.) Conceptualizing Cross-National Distance and Multinational Firm Configurations; 4.) Global Integration and Innovation within Multinational Corporations; and 5.) Global Sourcing and Its Impact. These themes address different aspects of the strategic and organizational choices MNCs make across product and geographic markets. I draw from and combine theoretical arguments from the disciplines of strategic management, international economics and international business to be able to better understand the complexity that is inherent in expansion across product and geographic markets.

Below, I briefly summarize my main publications and contributions in each of these research streams.

1,) Performance Effects: In my first research stream, I focus on understanding how the foreign operations, activities and investments of firms impact their performance. Although it is typical for studies in the global strategy literature to search for a generalizable and aggregate performance effect from multinationality, all of my papers in this research stream explore the ways in which the multinationality-performance relationship is contingent upon country contexts and firm resources and experiences (Berry and Sakakibara, 2008; Berry, 2015; Berry and Kaul, 2016). More specifically, I have explored how shareholders respond to different firm foreign investment location decisions, given different firm experiences and capabilities (Berry and Sakakibara, 2008). I have examined how heterogeneous investment experiences across different foreign country locations impact shareholder valuation of multinationality (Berry, 2006b) and how transfers of parent firm knowledge impact the performance of foreign operations, depending on the technological characteristics of the foreign country and the type of parent firm knowledge that is transferred (Berry, 2015). More recently, after accounting for the endogeneity of multinationality, Aseem Kaul and I tested for the existence of an S-shaped relationship between multinationality and performance across all US MNCs from 1989 to 2007, but found no evidence of an S-shaped pattern, or indeed, of any effect of multinationality at an aggregate level (Berry and Kaul, 2016). We have also explored how aggregation, adaptation and arbitrage activities are associated with firm performance (Berry and Kaul, 2022), providing an empirical account of the prevalence of different combinations of global activities and their association with firm profitability. Taken together, the studies in this research stream show that the effect of multinationality varies with firm capabilities and home country environments, and that managers and academics alike should focus on understanding these contingent relationships, rather than searching for a universal effect of multinationality on performance.

2.) Resource Allocation Decisions: In my second research stream, I examine the roles that both investment and divestment play in firm scope. By exploring both the international economics literature insights on substitute and complementary relationships across home and foreign country investments and the strategic management literature focus on firm resource allocation decisions, I offer more nuanced explanations for firm scope (Berry, 2013 and Berry, 2010). For example, by examining divestment not only as a choice managers make when dealing with poor or struggling operations, but also as a response to better opportunities for firm resources in other product and geographic markets, I explore how both divestment and investment fit into firm strategic decisions to allocate firm resources to their best opportunities across home and foreign markets (Berry, 2010). In Berry (2013), I examine how conventional arguments that firms are likely to divest their poorly performing operations are influenced by the product and geographic market characteristics of these operations in foreign markets. I have also examined how the technological capabilities of leader and laggard firms can influence the abilities of these firms to absorb foreign knowledge, showing that Japanese firms investing in foreign R&D tend to be the non-dominant market share firms that are also the technologically leading firms in their industries (Berry, 2006a). More recently, I have explored how organizational practices can buffer country-level institutional deficiencies for firm knowledge and influence the transfer of more or less valuable parent firm innovations to foreign operations (Berry, 2017). I use a confidential database that I created that includes the population of US MNCs from the BEA and their worldwide patents from the Derwent patent database in this paper and the empirical results show that MNCs are more likely to transfer parent firm knowledge to foreign operations located in weak IP protection countries when those operations have home country expatriates. Further, the results show that there is a significant increase in the value of parent firm knowledge that is transferred to operations with home country expatriates in weak IP protection countries when those operations have higher absorptive capacity.

3.) Conceptualizing Distance and Multinational Firm Configurations: In my third research stream, I have attempted to expand the conceptualization of both cross-national distance and multinational firm configurations. Though international business scholars have tended to define distance in broad terms, they have measured it rather narrowly. By combining the insights from international business and institutional perspectives, I capture richer characterizations of the ways in which countries differ (Berry, Guillen and Zhou, 2010). We disaggregate the construct of distance by proposing a set of multidimensional measures, including economic, financial, political, administrative, cultural, demographic, knowledge, global connectedness and geographic distance (which we make freely available to other scholars). We argue that defining and measuring cross-national distance along multiple dimensions is important because different types of distance can impact firm, managerial or individual decisions in different ways, depending on the dimension of distance under examination. In addition, we (Berry, Guillen and Hendi, 2014) have used these distance dimensions to explore convergence and divergence across countries over the last half century. We find that countries have not evolved to be significantly closer or more similar to one another, although groups of countries based on their core-periphery status or membership in trade blocs exhibit increasing internal convergence and divergence between one another. Regarding multinational firm configurations, I have explored how key insights from highly cited and well-used frameworks that describe the strategies and structures of MNCs are reflected in the international configurations of US MNCs (Berry, 2017). I offer several underexplored characteristics of the configurations of US MNCs to guide future research on this topic. Finally, I have examined the growing importance of so-called “born global” firms and explored how these firms may be more similar to established multinational firms than is commonly acknowledged by examining founder and firm characteristics that have been accumulated prior to a firm’s inception (Bals, Berry, Hartmann and Rattich, 2013).

4.) Global Innovation: My fourth research stream incorporates my research interests on the global innovation activities of multinational firms. Despite long-standing arguments about the benefits multinational corporations can achieve from sharing and transferring their resources across borders, there has been much less examination of how MNCs manage, control and coordinate innovation activities across their worldwide operations. In Berry (2014), I explore how more basic relationships that have been established through manufacturing integration can enable multi-country collaborations, while also showing that these collaborations bring together diverse knowledge that is used in subsequent innovations within firms. In Berry (2018), I explored how varying degrees of embeddedness in the parent, host and third country knowledge networks in foreign operations influence the type of knowledge that is generated in these operations to better understand how multiple knowledge communities interact and influence learning and innovation. Further, I have also brought together the knowledge management and multimarket competition literatures to enhance our understanding of the worldwide management of knowledge by MNCs in Berry (2020). I explore how multimarket overlap in knowledge activities influences firm decisions to internationalize their home-country generated innovations. While it is well-known and accepted that industry rivals influence the international expansion and investment decisions of each other, we know much less about how industry rivals influence the transfer and usage of firm proprietary knowledge abroad. I argue and show that overlapping R&D investments can allow rivals to access similar knowledge inputs that offer a credible threat to the preemptive use of a firm's knowledge. Overall, this paper examines the impact of credible strategic knowledge threats to firm proprietary assets from industry rivals. Across all of the papers in this stream, I explore how different types of linkages and integration across firm operations impact knowledge sharing and knowledge generation.

5.) Global Sourcing and Its Impact: My fifth research stream examines global sourcing by MNCs. MNCs pursue strategies of institutional arbitrage and I seek to better understand both the sourcing decisions of firms and the welfare consequences of these decisions. There are many data hurdles to studying what firms are actually doing across their operations and the BEA data provides information on cross-border linkages that are necessary to explore global sourcing and its impact. In Berry and Kaul (2015), we combine the theoretical logic for the choice of organizational form from the international economics tradition with the recognition in the global strategic management literature that firms are increasingly looking to foreign knowledge and expertise to develop a more complete theory of global sourcing. Both formal models and empirical tests show that firms who invest in foreign R&D also increase their levels of offshore integration, especially when they have strong capabilities, and especially from developed countries. In contrast, firms that do not invest in foreign knowledge seeking are more likely to pursue offshore outsourcing in response to cost pressures, especially when they have weak capabilities and when they are better able to monitor third party suppliers through investments in information technology. This paper contributes to the global strategy literature by examining the effect of knowledge-seeking investments on global sourcing decisions, and developing a formal account of the choice of organizational form for this product sourcing. At the same time, we contribute to the economics literature by incorporating into existing theory the insight that firms may look not only for low-cost inputs from foreign countries but also for foreign knowledge and expertise. In a recently published paper (Berry, Kaul and Lee, 2021), we argue that firms seeking to take advantage of lax regulations may prefer to do so through third parties. Census data on US manufacturing imports from 77 countries between 2006 and 2016 shows that indirect, third-party sourcing is as large as owned FDI in weak environmental standard countries, suggesting that this is an important means through which firms access weaker standards.

1,) Performance Effects: In my first research stream, I focus on understanding how the foreign operations, activities and investments of firms impact their performance. Although it is typical for studies in the global strategy literature to search for a generalizable and aggregate performance effect from multinationality, all of my papers in this research stream explore the ways in which the multinationality-performance relationship is contingent upon country contexts and firm resources and experiences (Berry and Sakakibara, 2008; Berry, 2015; Berry and Kaul, 2016). More specifically, I have explored how shareholders respond to different firm foreign investment location decisions, given different firm experiences and capabilities (Berry and Sakakibara, 2008). I have examined how heterogeneous investment experiences across different foreign country locations impact shareholder valuation of multinationality (Berry, 2006b) and how transfers of parent firm knowledge impact the performance of foreign operations, depending on the technological characteristics of the foreign country and the type of parent firm knowledge that is transferred (Berry, 2015). More recently, after accounting for the endogeneity of multinationality, Aseem Kaul and I tested for the existence of an S-shaped relationship between multinationality and performance across all US MNCs from 1989 to 2007, but found no evidence of an S-shaped pattern, or indeed, of any effect of multinationality at an aggregate level (Berry and Kaul, 2016). We have also explored how aggregation, adaptation and arbitrage activities are associated with firm performance (Berry and Kaul, 2022), providing an empirical account of the prevalence of different combinations of global activities and their association with firm profitability. Taken together, the studies in this research stream show that the effect of multinationality varies with firm capabilities and home country environments, and that managers and academics alike should focus on understanding these contingent relationships, rather than searching for a universal effect of multinationality on performance.

2.) Resource Allocation Decisions: In my second research stream, I examine the roles that both investment and divestment play in firm scope. By exploring both the international economics literature insights on substitute and complementary relationships across home and foreign country investments and the strategic management literature focus on firm resource allocation decisions, I offer more nuanced explanations for firm scope (Berry, 2013 and Berry, 2010). For example, by examining divestment not only as a choice managers make when dealing with poor or struggling operations, but also as a response to better opportunities for firm resources in other product and geographic markets, I explore how both divestment and investment fit into firm strategic decisions to allocate firm resources to their best opportunities across home and foreign markets (Berry, 2010). In Berry (2013), I examine how conventional arguments that firms are likely to divest their poorly performing operations are influenced by the product and geographic market characteristics of these operations in foreign markets. I have also examined how the technological capabilities of leader and laggard firms can influence the abilities of these firms to absorb foreign knowledge, showing that Japanese firms investing in foreign R&D tend to be the non-dominant market share firms that are also the technologically leading firms in their industries (Berry, 2006a). More recently, I have explored how organizational practices can buffer country-level institutional deficiencies for firm knowledge and influence the transfer of more or less valuable parent firm innovations to foreign operations (Berry, 2017). I use a confidential database that I created that includes the population of US MNCs from the BEA and their worldwide patents from the Derwent patent database in this paper and the empirical results show that MNCs are more likely to transfer parent firm knowledge to foreign operations located in weak IP protection countries when those operations have home country expatriates. Further, the results show that there is a significant increase in the value of parent firm knowledge that is transferred to operations with home country expatriates in weak IP protection countries when those operations have higher absorptive capacity.

3.) Conceptualizing Distance and Multinational Firm Configurations: In my third research stream, I have attempted to expand the conceptualization of both cross-national distance and multinational firm configurations. Though international business scholars have tended to define distance in broad terms, they have measured it rather narrowly. By combining the insights from international business and institutional perspectives, I capture richer characterizations of the ways in which countries differ (Berry, Guillen and Zhou, 2010). We disaggregate the construct of distance by proposing a set of multidimensional measures, including economic, financial, political, administrative, cultural, demographic, knowledge, global connectedness and geographic distance (which we make freely available to other scholars). We argue that defining and measuring cross-national distance along multiple dimensions is important because different types of distance can impact firm, managerial or individual decisions in different ways, depending on the dimension of distance under examination. In addition, we (Berry, Guillen and Hendi, 2014) have used these distance dimensions to explore convergence and divergence across countries over the last half century. We find that countries have not evolved to be significantly closer or more similar to one another, although groups of countries based on their core-periphery status or membership in trade blocs exhibit increasing internal convergence and divergence between one another. Regarding multinational firm configurations, I have explored how key insights from highly cited and well-used frameworks that describe the strategies and structures of MNCs are reflected in the international configurations of US MNCs (Berry, 2017). I offer several underexplored characteristics of the configurations of US MNCs to guide future research on this topic. Finally, I have examined the growing importance of so-called “born global” firms and explored how these firms may be more similar to established multinational firms than is commonly acknowledged by examining founder and firm characteristics that have been accumulated prior to a firm’s inception (Bals, Berry, Hartmann and Rattich, 2013).

4.) Global Innovation: My fourth research stream incorporates my research interests on the global innovation activities of multinational firms. Despite long-standing arguments about the benefits multinational corporations can achieve from sharing and transferring their resources across borders, there has been much less examination of how MNCs manage, control and coordinate innovation activities across their worldwide operations. In Berry (2014), I explore how more basic relationships that have been established through manufacturing integration can enable multi-country collaborations, while also showing that these collaborations bring together diverse knowledge that is used in subsequent innovations within firms. In Berry (2018), I explored how varying degrees of embeddedness in the parent, host and third country knowledge networks in foreign operations influence the type of knowledge that is generated in these operations to better understand how multiple knowledge communities interact and influence learning and innovation. Further, I have also brought together the knowledge management and multimarket competition literatures to enhance our understanding of the worldwide management of knowledge by MNCs in Berry (2020). I explore how multimarket overlap in knowledge activities influences firm decisions to internationalize their home-country generated innovations. While it is well-known and accepted that industry rivals influence the international expansion and investment decisions of each other, we know much less about how industry rivals influence the transfer and usage of firm proprietary knowledge abroad. I argue and show that overlapping R&D investments can allow rivals to access similar knowledge inputs that offer a credible threat to the preemptive use of a firm's knowledge. Overall, this paper examines the impact of credible strategic knowledge threats to firm proprietary assets from industry rivals. Across all of the papers in this stream, I explore how different types of linkages and integration across firm operations impact knowledge sharing and knowledge generation.

5.) Global Sourcing and Its Impact: My fifth research stream examines global sourcing by MNCs. MNCs pursue strategies of institutional arbitrage and I seek to better understand both the sourcing decisions of firms and the welfare consequences of these decisions. There are many data hurdles to studying what firms are actually doing across their operations and the BEA data provides information on cross-border linkages that are necessary to explore global sourcing and its impact. In Berry and Kaul (2015), we combine the theoretical logic for the choice of organizational form from the international economics tradition with the recognition in the global strategic management literature that firms are increasingly looking to foreign knowledge and expertise to develop a more complete theory of global sourcing. Both formal models and empirical tests show that firms who invest in foreign R&D also increase their levels of offshore integration, especially when they have strong capabilities, and especially from developed countries. In contrast, firms that do not invest in foreign knowledge seeking are more likely to pursue offshore outsourcing in response to cost pressures, especially when they have weak capabilities and when they are better able to monitor third party suppliers through investments in information technology. This paper contributes to the global strategy literature by examining the effect of knowledge-seeking investments on global sourcing decisions, and developing a formal account of the choice of organizational form for this product sourcing. At the same time, we contribute to the economics literature by incorporating into existing theory the insight that firms may look not only for low-cost inputs from foreign countries but also for foreign knowledge and expertise. In a recently published paper (Berry, Kaul and Lee, 2021), we argue that firms seeking to take advantage of lax regulations may prefer to do so through third parties. Census data on US manufacturing imports from 77 countries between 2006 and 2016 shows that indirect, third-party sourcing is as large as owned FDI in weak environmental standard countries, suggesting that this is an important means through which firms access weaker standards.

Heading photo of fjords taken near Voss, Norway